Changes that reshaped Germany’s dairy sector

Milk production is the most important branch of German agriculture and the dairy industry is the largest sector within the German food industry. Germany’s dairy industry is therefore exceedingly important. Germany has the highest milk production of all countries within the EU, followed by France. However, the industry as a whole has undergone major structural change in recent years.

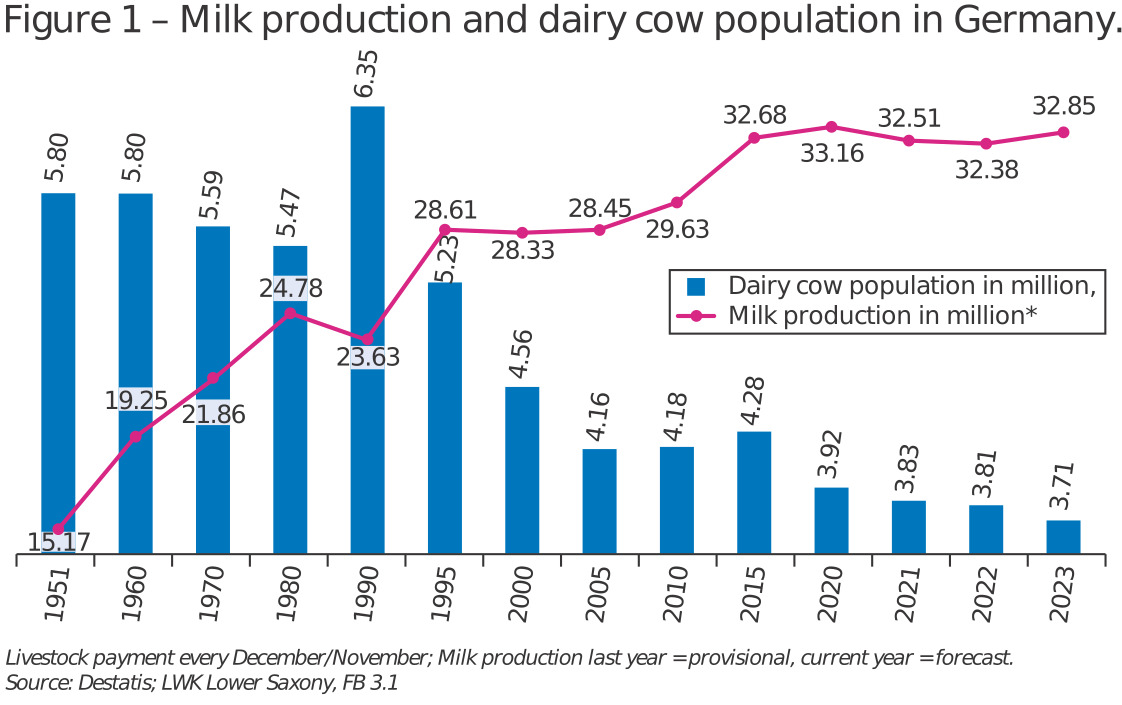

At the turn of the millennium, there were around 4.6 million dairy cows kept on 138,500 farms. Due to ongoing structural changes, the number of dairy farms has fallen sharply. In 2023, there were still around 46,600 commercial dairy farms, which is about one-third of the total in 2000. The number of dairy cows decreased significantly. Here, a decrease of 21% to just under 3.8 million was recorded. In the 1950s and 1960s, Germany had around 5.8 million dairy cows and some 2 million milk producers.

In contrast to the structural figures, milk production has increased almost continuously. The highest level to date was reached in 2020 with 33.1 million kg of milk. Around 31.8 million tonnes of this was delivered to dairies, with the milk yield per cow per year amounting to 8,457 kg. In 2020, the diary industry accounted for 18.9%, and animal products for 41.2% of German agricultural production value.

Surviving in the globalised market

There are many reasons for structural change, one of the more common reason being a lack of farm succession between generations. However, even in economically difficult phases, which occur more frequently in the highly volatile milk market, more people are leaving milk production. Besides economic aspects, milk producers have to overcome increasing environmental protection and animal welfare challenges. Smaller farms are particularly affected by the structural change.

The average number of dairy cows per farm increased to 74 in 2024 as a result of the concentration process. By comparison, the average was 37 dairy cows per farm in 2004. But German farm sizes vary greatly. While an average of 150-240 cows are kept per farm in the eastern German federal states, the figure is 45-60 cows in the southern federal states. Just under 600 German dairy farms currently keep more than 500 cows. Lower Saxony and Bavaria have the most dairy cows in total. The average milk yield in 2023 was 8,557 kg.

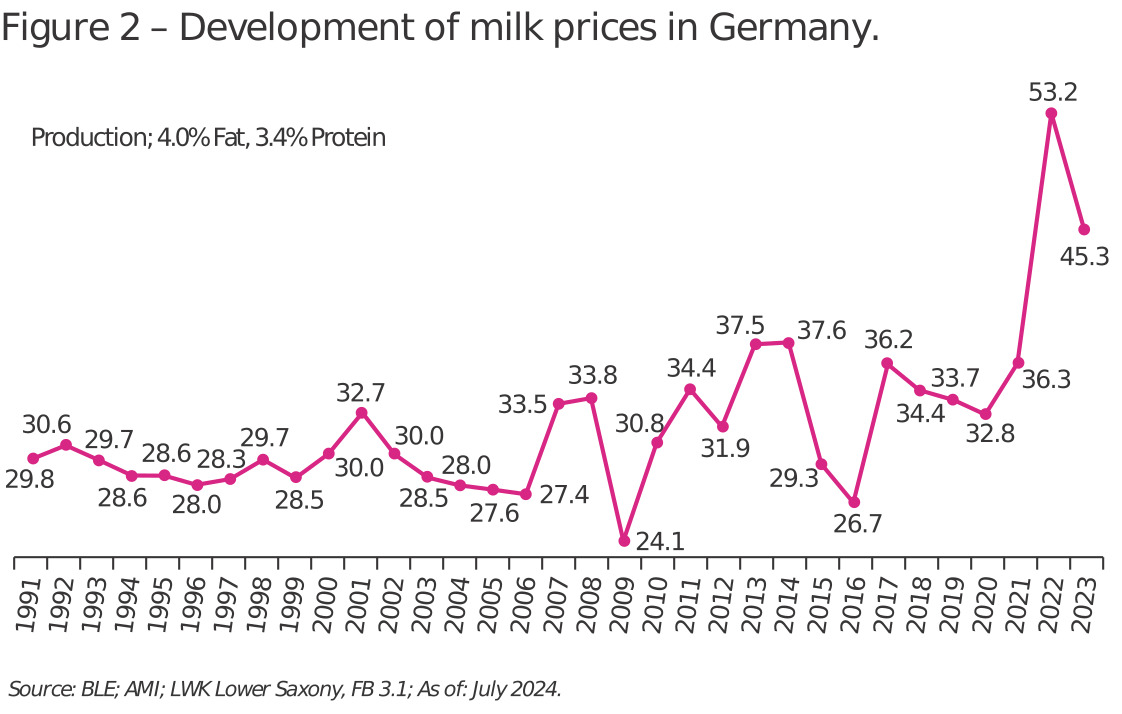

The average number of dairy cows per farm increased to 74 in 2024 as a result of the concentration process. By comparison, the average was 37 dairy cows per farm in 2004. But German farm sizes vary greatly. While an average of 150-240 cows are kept per farm in the eastern German federal states, the figure is 45-60 cows in the southern federal states. Just under 600 German dairy farms currently keep more than 500 cows. Lower Saxony and Bavaria have the most dairy cows in total. The average milk yield in 2023 was 8,557 kg. Since the milk quota (introduced in 1984) was phased out in 2015, and more recent reforms to the EU’s Common Agricultural Policy (CAP), the influence of political administration has decreased. As a result, world market influences and thus the volatility of milk prices has increased, leading to various milk market price crises.

The dairy industry is also affected by structural change. Similar to milk production, there is also a trend towards larger dairies. The number of milk-processing companies fell from almost 3,500 in 1950 to 161 in 2023. The main reason for this development has been the increased business efficiency required to survive in the globalised market. It can be assumed that this trend will continue in the coming years and that there will be further mergers.

Consumption and dairy trade trends

The per capita consumption of dairy products in Germany has decreased overall in recent years. In 2023, 45.8 kg of drinking milk was consumed per capita, with self-sufficiency now at 107%. In the 1990s, per capita consumption was over 60 kg. On the other hand, cheese consumption continued to increase until 2021. However, In the past 2 years this has declined to 23.8 kg per capita. Increases in production, due to high added value on the global market, means that self-sufficiency is now up at 128%. Butter consumption has also weakened in recent years and stood at 5.6 kg per capita in 2023, down from 6.3 kg in 2020. Butter self-sufficiency is now 102%. Germany is a net exporter of most dairy products.

Foreign trade plays a very important role for the German dairy industry. Around half the milk produced is currently exported in the form of dairy products, and with an export volume of 1.4 million tonnes, cheese is the frontrunner. In 2023, the largest buyers of German cheese products within the EU were Italy, the Netherlands and France. The United Kingdom, Switzerland, Japan and South Korea were the largest buyers outside the EU. The Asian market plays a major role for the German dairy industry overall. Changes in eating habits have recently led to increased sales of products such as butter.

Sustainability dominates in the dairy sector

In addition to further developments in animal welfare, sustainability has also dominated the dairy industry in recent years. The public debate about the impact of milk production on the climate has been going on for several years. In response, the industry has taken initiatives, identifying potential areas for improvement and optimisation which will also achieve more efficient value creation. In simple terms, sustainability consists of the 3 pillars of economy, ecology and social responsibility.

German food retailers have set themselves the goal of only offering fresh milk products from higher forms of husbandry in the coming years. Criteria for higher forms of husbandry include free-range farms, grazing and more space per animal in the barn. Sales of pasture-raised milk have risen to over 11% in recent years. Only milk from cows that have had access to pasture for at least 6 hours on at least 120 days a year can be labelled as pasture milk. However, due to the fierce competition, the bonus payments from dairies are barely sufficient to cover the additional costs. The proportion of organically-produced milk has risen slowly in recent years to its current level of 4.5% and therefore only accounts for a small proportion of milk production.

Will Germany remain the largest producer in the EU?

As in most EU countries, the German dairy industry has undergone huge structural changes, which are still ongoing. If Germany is to remain the largest producer in the EU, its export business as well as domestic demand is vitally important, as around half the milk produced must be sold on the world market. Dairy farms are currently facing major challenges. To counter the social debate on the effects of climate change, it is essential that sustainable farming practices become embedded in the industry’s future strategy.