Will 2024 be a good year for N. American dairy? What economists say

Whilst 2023 was challenging for dairy farmers in the US and Canada, 2024 should be a better year, according to industry experts.

In the US, milk prices dipped in 2023 compared to 2022, while the cost of feed and other inputs spiked. Indeed, 2023 saw the lowest profit margins for US dairy farmers since the recession of 2009.

Looking forward, economist Chuck Nicholson of the University of Wisconsin-Madison, said recently that the use of innovative feeding and breeding strategies have resulted in an 11% increase in butterfat per cow over the past year, which boosts profits for farmers.

Exports for US dairy products such as cheese, dry whey, skim milk powder, non-fat dry milk and butter are expected to be good this year. In addition, Nicholson thinks milk prices will rebound this year, moving up in their typical cycle of dips and peaks. Pricing formulas may also change for the better, but this is still uncertain.

However, there are several factors that could put 2024 at risk as a good year for the US dairy industry, according to Nicholson. These include the global economy, weather patterns, inflation control and what’s contained in the US federal agriculture funding bill, known as the farm bill.

Canada

North of the US border, Graeme Crosbie, senior economist at national agricultural lender Farm Credit Canada, also has a positive attitude for 2024.

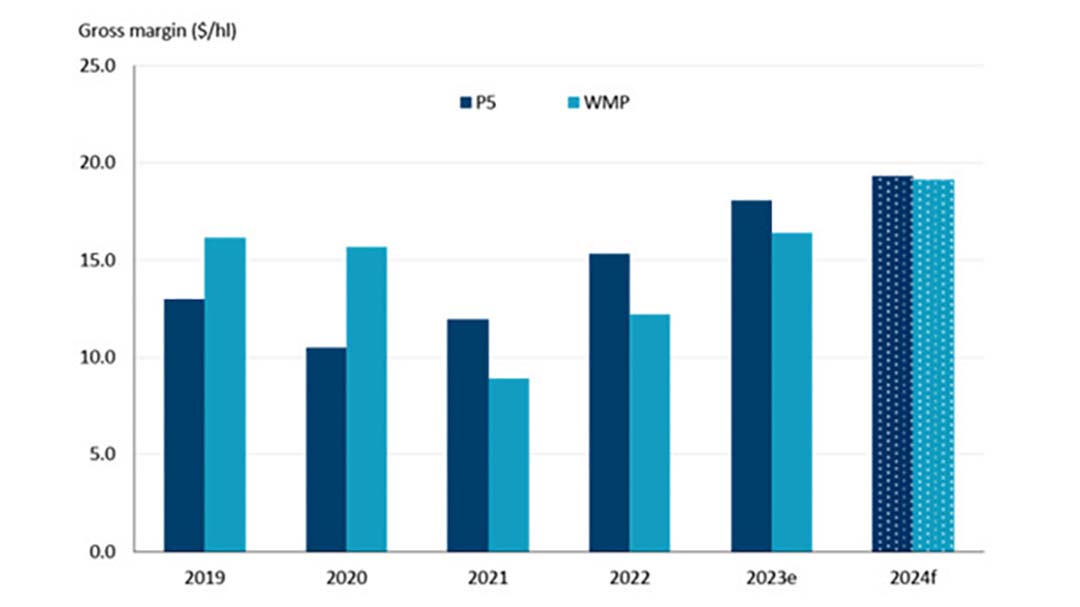

“Higher processor demand and still-low butter stocks are setting the stage for more milk production from Canadian dairy farmers in 2024,” he recently stated. “This, combined with strong culled cow/calf prices and stabilising – though still high – input costs provide context to our average gross margin estimates for 2024, which look better than they have in the last few years.”

Figure 1 – Estimates of average gross dairy margins in Canada ($/hl), 2019-24 (Farm Credit Canada)

*Gross margin is total revenue less total variable costs (including feed). Fixed costs and return to management are excluded from the calculation. We do not include fixed costs as these vary greatly between operations.

**The calculations use different definitions of cost categories for the P5 and WMP and therefore values are not directly comparable.

Sources: Statistics Canada, Canadian Dairy Commission, Government of Alberta, FCC Economics

Crosbie also noted that as of 1 February, the Western Milk Pool (WMP) increased milk quota. In Canada’s supply-managed milk production system, the amount of milk going into the commercial market, called quota, is controlled. The increases are intended to balance the quota across the 4 western Canadian provinces. No quota increases in eastern Canada have been announced at this time.

Additionally, a farm gate milk price increase of 1.8% will go into effect on 1 May 2024.

Crosbie says: “Between increased production and slightly higher farm gate prices, total farm cash receipts for the dairy sector are forecast to increase 3.7% this year. Continued strong culled cow/bull calf prices in 2024 will provide an additional boost to profitability.”

Factors to watch

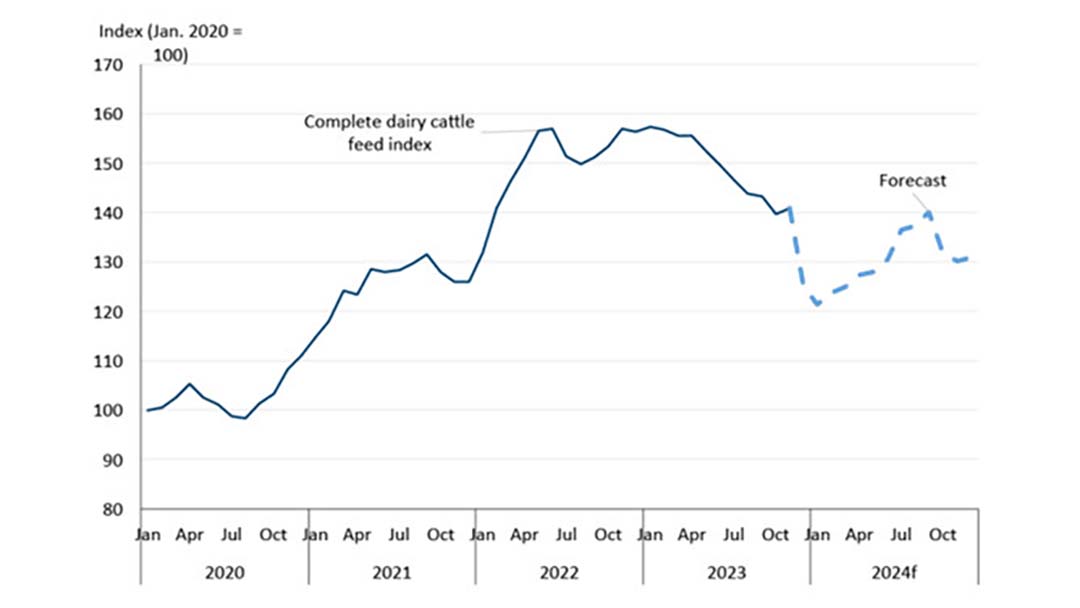

However, dairy farmers in Canada, similarly to the US, should watch feed prices and availability, butter stocks, retail demand for dairy products, inflation, interest rates and how the growing season unfolds in the Prairies.

Indeed, Crosbie says feed availability and pricing will be the ultimate determinant of profitability for Canadian dairy farmers in 2024.

Figure 2 – Feed costs in Canada forecast to ease for dairy farmers further in 2024 (Farm Credit Canada).

Source: Statistics Canada, FCC Economics

Join 13,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the dairy sector, two times a week.