Insights into the plant-based dairy market

Plant-based dairy alternatives are steadily gaining ground in supermarkets and the on-trade. With an expected market growth of 12% per year on average towards 2027, this trend looks set to continue in the near future.

While some of the growth is driven by increased consumer interest in animal welfare and the environmental impact of livestock production, consumer surveys show that lactose intolerance plays a greater role in the purchasing behaviour of consumers of plant-based dairy alternatives.

In the latest trend report on Plant-Based Alternatives, there is a deep dive analysis on the performance of companies with a focus on plant-based alternatives within the agri food industry. Let’s take a closer look at the 2 best-known producers of plant-based dairy alternatives, Alpro and Oatly. After analysing their annual reports, we can see that both companies occupy a different position within this growing market.

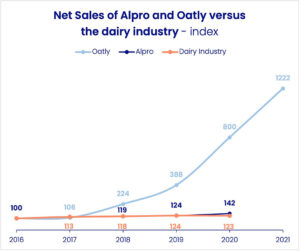

The originally Belgian Alpro has been making dairy alternatives from soy protein since the 1980s. Since 2016, the company is owned by dairy giant Danone and has shown steady growth, but has not surpassed the average growth rate of the dairy industry until 2020. Swedish company, Oatly, which has been making dairy alternatives from oats since the 1990s, has shown very strong growth after a shift in strategy in 2012.

Key insights from market and company analysis for the 2 companies:

Exponential growth is not a given in the plant-based segment

Alpro struggles to outpace the traditional dairy industry in terms of growth. Oatly, on the other hand, show strong growth, mainly benefitting from strong increases in demand in relatively new markets (Americas +80%, Asia +136.5%).

Alpro struggles to outpace the traditional dairy industry in terms of growth. Oatly, on the other hand, show strong growth, mainly benefitting from strong increases in demand in relatively new markets (Americas +80%, Asia +136.5%).Marketing and entry strategy an important differentiator

While there are many reasons for an established brand like Alpro to grow at a slower pace that a ‘young’ brand like Oatly, a large part of Oatly’s success is attributed to it smarketing efforts. The company uses quite unconventional tactics:

· Going straight to the frontline to create brand awareness – entering a country first through high-end coffee shops. The idea behind this is that if your local barista works and recommends the product in a perfectly prepared latte, it must be good, right?

· A ‘no marketing strategy’ – Oatley focuses on creating exposure for its products by making fun of traditional marketing campaigns.

While these tactics have been successful with oat milk products, time will tell if they will also work with new product ranges. The company introduced premium (higher kg price) ice-cream and yoghurt. This is an area that likely drives profitability for a more established company like Alpro.

Higher margins than traditional dairy businesses?

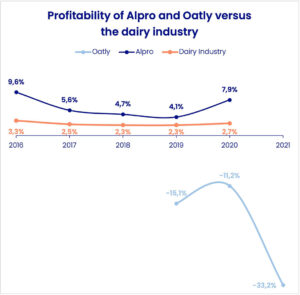

A-INSIGHTS’ analysis of the dairy industry shows that, on average, European dairy companies generated an operational margin of 2.7% of net sales in 2020, up from 2.3% in 2018 and 2019. This shows that higher margins than traditional dairy businesses are possible for plant-based dairy producers, but it might take a while to achieve.

Oatly has seen growth accompanied by severe pressure on margins, resulting in the company generating an operating loss (EBIT) of 33.2% by 2021. The company says it has not been able to utilise production facilities sufficiently due to logistical constraints and the effects of Covid-19, resulting in margin pressure. An important reason for the pressure the company is experiencing is the low share of own production – Oatly only produces 25% of its sold volume itself.

Oatly has seen growth accompanied by severe pressure on margins, resulting in the company generating an operating loss (EBIT) of 33.2% by 2021. The company says it has not been able to utilise production facilities sufficiently due to logistical constraints and the effects of Covid-19, resulting in margin pressure. An important reason for the pressure the company is experiencing is the low share of own production – Oatly only produces 25% of its sold volume itself.Alpro, on the other hand, is profitable. It took the company roughly 30 years to become profitable structurally but in recent years the company realised more than double the margin of traditional dairy companies.

Many stand-alone companies will not make it

Looking at the broader spectrum of companies active in plant-based alternatives, we can see that only a few companies are profitable. With the space becoming more competitive, and the funding environment becoming more conservative (interest rates are increasing, valuations for high risk companies are decreasing), it will be a challenge to raise enough funds to realize profitability stand-alone soon.

A company like Oatly can survive for about 3 years with its current cash position if it is able to keep losses stable. After that it will need to raise funds and with its share price currently down, 95% from its highs that will become a challenge.

Therefore we expect that the food conglomerates will be watching the space for companies ready to be acquired. The companies under the hood of food majors therefore have an advantage as they can:

1. Offer a one-stop-shop for multiple product categories and can leverage their distribution networks and relationships with key accounts (supermarkets, wholesalers and restaurants). This is something that the more immature companies still have to build.

2. They have longstanding expertise of production and operational efficiency.

3. They can secure funding more easily, given that they can leverage their size and profitability.

For the full analysis of companies with a focus on plant-based alternatives within the agri food industry, download the Trend Report Plant-Based Alternatives (for free).