FrieslandCampina sees opportunities for further growth in Indonesia

A glass of milk every day for all 70 million schoolchildren – this plan by the new president of Indonesia represents an unprecedented opportunity for the currently relatively small dairy sector in the country. Meeting this demand will require a drastic increase in production within the country itself, as well as more imports. And in addition to this plan, FrieslandCampina sees major growth opportunities in the country, where it recently opened a large new factory.

A new president will take office in Indonesia this autumn. Prabowo Subianto is the successor to Joko Widodo, who was in power for 10 years. Subianto made a special election promise that won him many votes: a free daily meal for all schoolchildren – with dairy. If this happens, it will mean a huge expansion of the dairy market, where 70 million children should receive milk every day. There isn’t even that much milk in the country. It is a mega project, which in terms of size is compared to the largest project of predecessor Joko Widodo – the construction of a completely new capital on the island of Borneo.

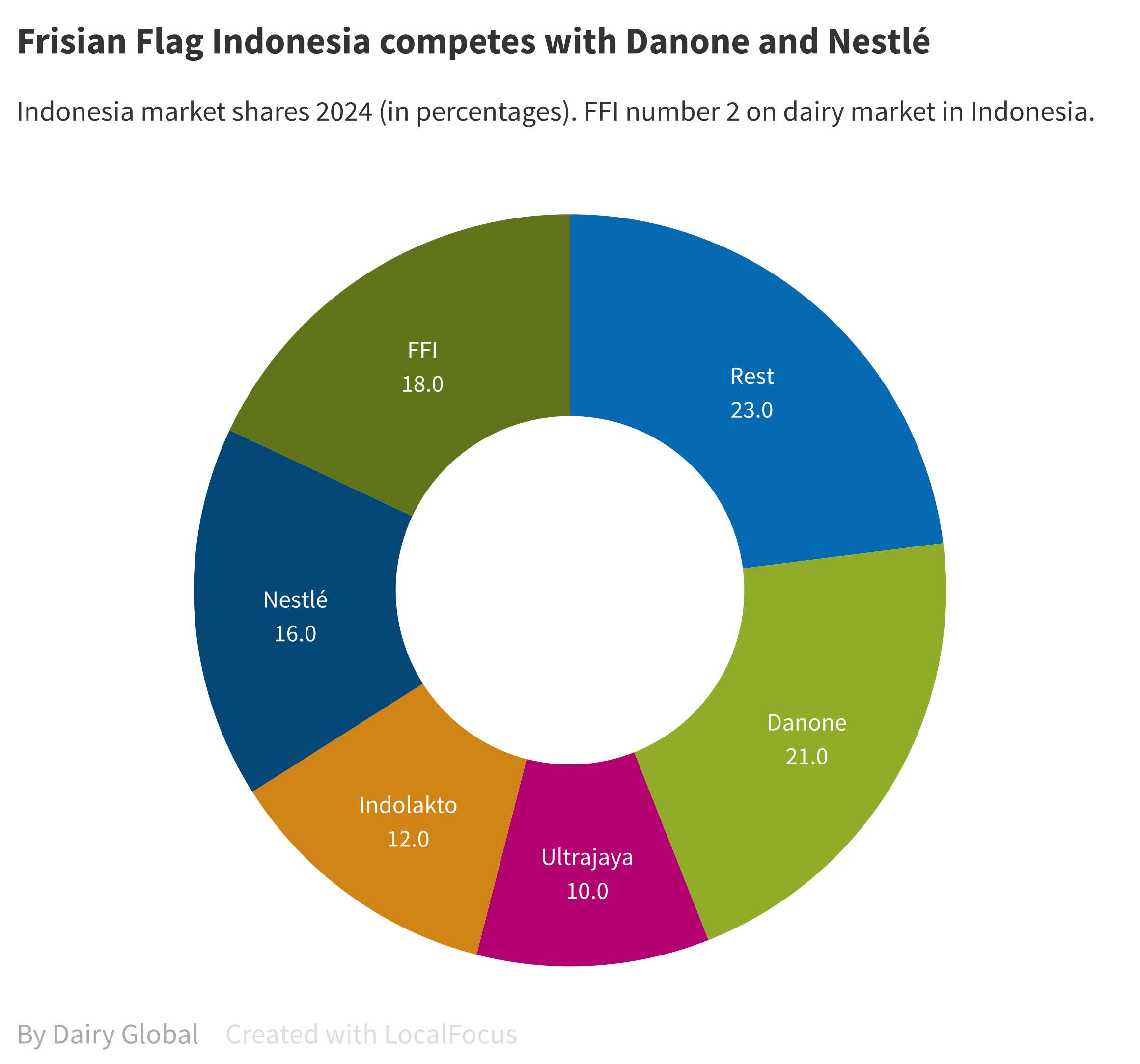

It all still has to happen – nothing is certain – but the promise is serious, as they look to Frisian Flag Indonesia (FFI), the country’s second dairy producer and subsidiary of FrieslandCampina. It’s a huge opportunity, but at the same time no one knows where all that dairy would come from. FFI doesn’t have that much in-house, and neither do industry peers. The country does not produce nearly enough itself, so much more will have to be imported. And then we haven’t even mentioned the enormous logistical challenge for the country with thousands of islands.

Mountains of gold

Nearby dairy countries such as Australia and New Zealand are already dreaming of mountains of gold. But it remains to be seen whether a lot of money can actually be made from it, says Berend van Wel, CEO of FFI: “If it continues, you are talking about enormous quantities. But the margins will be small.” He does dare to say that Frisian Flag Indonesia can grow into one of FrieslandCampina’s largest branches in terms of volume. But, it all still has to be done. The president is not yet in office and a budget still needs to be found.

The idea of providing food to schoolchildren fits in with the new president’s vision for Indonesia’s economic development. The country now mainly derives its income from raw materials, such as palm oil and all kinds of minerals. But most value addition takes place abroad, during processing into higher-quality products. That needs to change, Subianto believes. In order to create more value in the country itself, a well-educated workforce is needed. That starts with good education. But what good is education if the children are malnourished? Malnutrition and, above all, single-food nutrition, is still common in Indonesia. While lifestyle diseases such as obesity are also on the rise here, there are still many young children with growth retardation as a result of malnutrition or single-food diet, according to a large study in which FFI participated.

Dairy consumption in Indonesia

Dairy consumption in Indonesia is very low, Indonesians consume relatively little dairy. According to market research, consumption is very low at only 16 kgs per person per year. Even compared to culturally-related neighbouring countries in Southeast Asia, it is low. In Malaysia, Thailand and Vietnam, it varies from 26-36 kgs. Baby food is big. In shops, huge shelves are set up for baby milk powder of different brands, with separate mixes for each age.

Indonesia’s own production must increase

In addition to better nutrition for the population, the Indonesian government is also striving for greater self-sufficiency in the field of dairy. Indonesia now provides more than 20% of its own milk needs. The rest comes from imports, mainly in the form of skimmed milk powder that is processed there. Milk production does grow slightly every year but cannot keep up with the growth in demand. Two years ago, there was also a sharp drop in production due to a major outbreak of foot-and-mouth disease. Despite a vaccination campaign, national milk production fell by 30-50% that year. The accumulated backlog has now been made up for by half, they estimate at FFI. “We have had some tense moments in recent years due to tight supply,” says FFI director Van Wel. The FrieslandCampina subsidiary buys milk from cooperatives.

Almost 3-quarters of Indonesian milk production comes from 44,500 small farmers who are affiliated with one of the 61 dairy cooperatives. In addition, there is a limited number of modern, large companies that supply directly to dairy factories. Total production in 2023 was around 570,000 tonnes. The Indonesian government is very keen to increase domestic production, preferably by stimulating and supporting small companies. If that does not work, there are other options.

Rumours? Companies with 10,000 cows

Another option could be to expand modern companies that are already there. These are local entrepreneurs. But there are also other ideas, such as a story about an investor from Qatar who wants to set up a company with 10,000 cows. Chinese companies are also said to be interested in investing in large-scale dairy farming. But that remains in the realm of rumours.

Is it conceivable that FFI will step in here? Van Wel: “Possibly in a partnership with another company. But not by setting up a large company yourself, if only because you would then end up with a lot of problems. There is no good land available anywhere on Java; you have to get the feed from somewhere and find a solution for the manure. But this much is clear: 100% local dairy will be difficult.” The approach of the joint dairy companies in Indonesia is: enter into a dialogue with the government, and see together what is possible.

Export from the new factory

Frisian Flag Indonesia supplies dairy products for the Indonesian market and will also export from the new factory in Cikarang near Jakarta within the Southeast Asian region. The factory processes 400 tonnes of local milk per day, which is approximately 150,000 tonnes per year. According to Van Wel, local milk accounts for more than half of the total amount of processed milk, but he does not provide precise figures on the ratio of local to import. The output of the factory is 700,000 tonnes of dairy products, and that can grow to 1 million tonnes. In addition to milk, other raw materials are also used in these products, such as sugar and vegetable fats.

Indonesian consumers have little money

The milk from Javanese farmers is processed in the new factory in Cikarang and ends up on the consumer market in, among other things, sweetened condensed milk (the same product that it all started with in Indonesia a century ago). Consumers dilute these products with water or use them as toppings. The packaging is small to very small. A packaging of 38 g bags is very popular. These are sold per 6 pieces for €0.50. Sometimes they are made from milk powder with added vegetable fats, to keep the price low. The Indonesian consumer has little money, lives more or less from day to day, and prefers to buy small packages.

In addition, there are ready-to-drink products, also in all kinds of shapes, sizes and flavours. Most variants are very sweet by Dutch standards, often with 20% sugar and sometimes more than 30%.

Local dairy production

At the old Pasar Rebo location in Jakarta, FFI mainly produces baby and infant food based on imported milk powder. Pasar Rebo is the location where the company’s first factory was built in 1969.

How important is local dairy production for FFI? Very important, Van Wel emphasises. The government wants more home production. And people also want dairy from the country itself in the product, because of the fresh experience, he explains.

The government wants to protect the local market with import restrictions and a mandatory minimum amount of local ingredients. Yet many product names are in English, because that increases the appeal; in addition to the Indonesian name, English gives an international image of quality. The total dairy market in Indonesia amounts to approximately €3.5 billion, they estimate at FFI. If the government plans for infant nutrition go ahead, billions more will be added.

Join 13,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the dairy sector, two times a week.