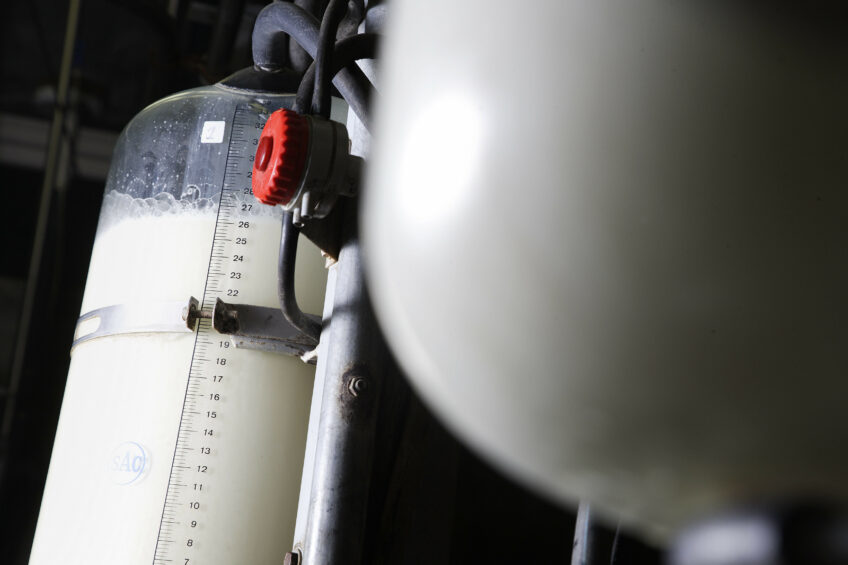

Dairy market: What to expect in 2018

Global milk supplies grew, butterfat prices went sky high and skim milk powder prices remained depressed. This is in short what the global dairy sector experienced in the last 2 quarters of 2017.

This is according to the latest dairy quarterly report from Rabobank. According to the Dutch agri-food bank, the pressure of increasing milk supply across the key export regions began to take a toll on global commodity prices in Q3 2017. Butterfat prices were extremely high, but have more recently trended towards US$ 4,500/tonne, still comfortably above the historical average butter price. On the other hand, skim milk powder prices went down, due to closure of the European intervention scheme.

Dairy commodity prices

Looking forward, growth in milk supply in the Big 7 continued in Q3 2017 at 2.2%. This is the fastest pace since late 2016. Rabobank expects that this growth will continue throughout 2018, but at a slower rate. Regarding milk prices, the bank forecasts that prices will be eased. The first signs of weaker milk prices (in local currency) have emerged in a number of export regions. In China, milk prices continue to inch higher, but ongoing industry consolidation and unfavourable weather have hampered production growth.

What to watch in Q1 and Q2

According to Rabobank, several situations need to be watched in the new year. The drought in New Zealand for example. But also the fact that intervention stores will open in Europe from March 1st 2018, with the European Commission carrying 376,000 tonnes of skim milk powder. Also the risk of a US exit from NAFTA has increased after 5 rounds of ‘modernising’ the agreement have failed to advance amendments to the existing agreement. 2 more rounds are scheduled for 2018. Also, Chinese regulations need to be watched. China is tightening environmental protection regulations, with local government zones prohibiting animal farming in certain regions. Furthermore, tensions in the Middle East have escalated, although this didn’t lead to discernible impacts on the dairy market yet.

[Source: Rabobank]

Join 13,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the dairy sector, two times a week.