World-first carbon tax for Danish farmers

After 5 months of intense negotiations the Danish government is introducing an agricultural carbon tax payable by farmers, the first of its kind worldwide.

From 2030, this climate tax on agriculture will be charged at 300 Danish krone (€40; US$43) per ton of CO2e produced, increasing to 750 Danish krone (€100; US$107) by 2035.

However, a basic deduction, or tax break, of 60% will be applied to the average emissions from different types of livestock, providing an economic advantage to climate-efficient farmers.

Following this reduction, farmers will pay 120 Danish krone (€16; US$17) per ton of CO2e in 2030, and 300 Danish krone in 2035.

Denmark is a big exporter of dairy and pork produce and agriculture emissions make up 22.4% of the country’s total carbon emissions, compared with 15.6% ten years ago.

Danish livestock

In terms of numbers, Denmark has 547,000 dairy cows, on 2,300 farms, producing 5.87 billion kg of milk per year. It has around 900,000 beef and other cattle as well as 11.5 million pigs.

How will tax impact on carbon production?

Experts believe the carbon tax will slash 1.8 million tonnes of carbon production in its first year of operation, enabling Denmark to meet its target of cutting 70% of its total emissions by that year.

Tax creators

This bold move comes with the agreement between the coalition government and a number of Danish farming bodies and is likely to set a precedent for other countries to follow.

Sanctioning the tax with the Danish government were the Danish Agriculture and Food Council, the Danish Society for Nature Conservation, the Confederation of Danish Industry, the Trade Union NNF, and the Danish Local Government Association.

The Danish Dairy Association said it was pleased with the clarity the tripartite agreement brings to milk producers.

Agreement goes before Parliament

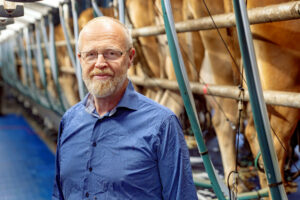

Dairy farmer Steen Norgaard Madsen, who is also chairman of the Dairy Association, said: “The Green Tripartite has had a very difficult task. The recommendations for how we in Denmark work with climate, biodiversity, forests and drinking water at the same time, are historic.

“No doubt this will change something on all farms, however Danish dairy farmers are skilled and are already in the process of reducing the carbon footprint. We will now focus on how the agreement, if agreed by the Danish Parliament, will be implemented.”

Monies raised from tax

The money raised by this carbon tax is said to be going back into the agricultural sector to enhance green initiatives and climate technology. Calls have been made to ensure this tax collection is regulated and that it should possible align with an emissions trading system at EU level.

High quality dairy

Peder Tuborgh, CEO of Arla Foods in Denmark, said: “Throughout the process we said that Arla, Arla’s farmers and the Danes basically want the same thing; that we have good Danish food of high quality and a low climate footprint.

“It is positive that there is now a broadly based agreement which gives us the opportunity to look ahead.”

In addition to the CO2 tax introduction, the agreement includes funding for the establishment of more forests in Denmark, and increased peatland restoration to ensure clean drinking water, with a clear ambition to comply with the EU Water Framework Directive.

Non-Danish farmers react to tax

Meanwhile, farmers around the world took to social media to comment on the tax. Some called it “a real breakthrough moment for agriculture” whilst others said: “Take note, this nonsense is coming our way too.”

An Irish dairy farmer said: “A Danish minority government of social democrats propped up by a green party; pushing the farmer out of business.”

Join 13,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the dairy sector, two times a week.