Mexico’s dairy sector remains resilient

With 129 million citizens, Mexico’s dairy sector continues to offer growth potential to US exporters and domestic producers. The dairy industry has proven resilient and a hardy dairy herd, access to water, and sizeable domestic feed production have helped continue to expand milk yield and supply.

It is estimated that Mexico’s dairy sector produced 12.85 mmt of milk in 2021, while production in 2022 is forecast at 12.98 mmt (+1%). Holsteins are the main breed used in more industrialized dairies where an average of 37 litres of milk/cow/day is achieved. This compares to an average of 9 litres/cow/day using breeds mixed with Cebu cattle (Bos indicus).

Mexico’s dairy landscape

The country’s dairy production sector is comprised of about 250,000 dairies, the majority of which are micro and small operations with less than 100 dairy cows each. Many milk producers went bankrupt or downsized their herds because of rising input costs and the effects of the Covid-19 pandemic. Vertical integration increased to the benefit of bigger dairy companies, while some troubled milk producers joined other dairies or formed cooperatives.

Nonetheless, the country’s dairy herd and the amount of milk it produces continues to grow as large producers continue to invest in manufacturing practices and genetics to improve milk quality, yield, heat resistance, and disease resistance.

Milk consumption in Mexico

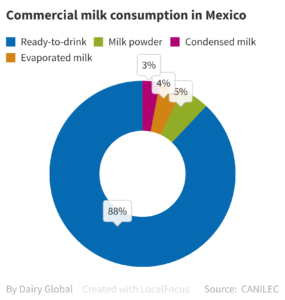

Mexico’s annual milk consumption is the lowest in North America at 62 litres per person (Canada: 76 litres; USA: 68 litres). The country’s overall milk consumption is estimated at 13.04 mmt in 2021 (household 4.15 mmt and industrial 8.9 mmt). For 2022, consumption is forecast at 13.17 mmt (+1%). Social milk distribution programmes, the re-opening of the retail and institutional sector, and growing commercial use are expected to drive demand.

Milk imports and exports declining

Mexico’s milk imports in 2021 are forecast at 30,000 mt while in 2022 at 29,000 mt (-3%) based on sufficient domestic milk production to meet national consumption needs. The Mexican dairy industry estimates it will be able to satisfy national demand with approximately 85% domestic milk and 15% imported milk.

Meanwhile, in 2021, exports are estimated at 17,000 mt, and in 2022 at 15,000 mt (-12%) as domestic milk use is expected to draw from exports. Guatemala and the US are expected to remain the primary export destinations.

Cheese production in Mexico primarily artisanal

Cheese production in 2021 is estimated at 448,000 mt while a 1% increase to 452,000 mt is expected in 2022. Soft crust cheeses represent 75% of the local market. Cheese production remains mostly artisanal and small scale, satisfying regional demand. Industrial cheese operations account for a quarter of cheese produced.

More cheese, please

Mexico’s cheese consumption has room to grow with the county’s per capita consumption reaching almost 4 kg per year. This compares to 17 kg in the US and 14 kg in Canada.

Mexico’s cheese consumption has room to grow with the county’s per capita consumption reaching almost 4 kg per year. This compares to 17 kg in the US and 14 kg in Canada.Consumption in 2021 is estimated at 559,000 mt, with a 1% increase to 563,000 mt in 2022. On the domestic market, growth remains sluggish due to ongoing poor macroeconomic conditions; however, the reopening of the HRI sector is helping to boost consumption.

On the trade market, imports in 2021 are estimated to remain flat in 2022 at 123,000 mt with the US expected to remain the dominant supplier (80% market share), followed by the Netherlands (9%). Exports in 2021 and 2022 are estimated to remain flat at 12,000 mt.

Butter for bakeries keeps demand steady

Butter production in Mexico is led by 3 companies, with one major player commanding 70% market share. Production in 2021 is estimated at 235,000 mt and at 236,000 mt in 2022. The reopening of the HRI sector and ongoing demand from the industrial bakery and confectionary sectors have helped keep demand steady.

Consumption in 2021 and 2022 is estimated at 261,000 mt. Larger, industrial processors in sectors such as HRI, bakery, and confectionary, are driving butter consumption. Per capita consumption is low, at approximately 0.4 kg per person per year (compared to some of the highest per capita consumption in France at 8 kg or New Zealand at 5 kg).

Domestic production keeps up with demand for butter

Imports are estimated at 28,000 mt in 2021 and 2022 with domestic production expected to keep up with slow demand from the HRI and industrial processing sectors. New Zealand is expected to remain Mexico’s top butter provider, followed by the US. In 2021, exports are estimated at 2,000 mt with a 50% increase in 2022 to 3,000 mt.

Skim milk powder (SMP)

It is cheaper for Mexico to import SMP than to produce it. Only 5 dehydrating facilities operate in the country, which are not always working at full capacity. SMP production in 2021 is estimated at 45,000 mt while production in 2022 is forecast at 46,000 mt. About 80% of milk powder imports are from the US.

Consumption in 2021 is estimated at 343,000 mt with a 2% increase forecast to 348,000 mt in 2022. The reopening of the HRI sector has represented growth in demand and consumption, especially for baked goods and desserts.

HRI sector and aid encourage imports and exports of SMP

SMP imports are estimated at 334,000 mt in 2021 and forecast to increase 2% to 340,000 mt in 2022, with the being the main SMP supplier to Mexico (99% market share). The reopening of the HRI sector has created growth in demand, which domestic production cannot meet. Social milk distribution programmes also use milk powder to fortify their milk supply.

Exports, meanwhile, are estimated at 36,000 mt in 2021 and are forecast to increase by 6% to 38,000 mt in 2022. Export markets include Latin American countries, to which Mexico may send milk powder as regional aid.

Whole milk powder (WMP)

In 2021, WMP production is forecast at 123,000 mt, and is expected to increase marginally (1%) to 124,000 mt in 2022. Production of WMP in Mexico is limited by the availability of dehydrating infrastructure, however, the country benefits from an affordable and steady supply of WMP from the US.

In 2021, consumption is estimated at 112,000 mt, and in 2022, the forecast is 113,000 mt (+1%). Demand is driven by confectionery and bakery processes as well as industrial dairy processors developing products for consumers seeking dairy products labelled as healthy, fortified, and ‘grab-and-go’.

Mexico depends on WMP imports

Price and logistics incentivise WMP imports over domestic production. In 2021, WMP imports are estimated at 7,000 mt and is forecast to reach 8,000 mt in 2022 (+14%). The US is the dominant supplier (52%), followed by Uruguay and New Zealand. Mexico depends on these imports to satisfy demand for various products, including baby formula, and wellness and fortified products.

Exports of WMP for 2021 are estimated at 18,000 mt and are forecast at 19,000 mt for 2022 (+6%). Top export markets for Mexico’s WMP continue to be Colombia, Cuba, Venezuela, Belize, and Guatemala, which benefit from affordable Mexican prices and steady availability. Increasing domestic demand may, however, hinder export growth.

The information in this article has been extracted from a USDA GAINS report.