Mexico to leverage production of dairy products in 2024

The USDA’s Global Agricultural Information Network (GAIN) forecasts a higher production of dairy products in 2024, driven by relatively lower input and dairy ingredient prices and strong domestic demand.

Recent reports show that the 3 largest milk-producing countries in Latin America are Brazil, Mexico and Argentina. Statista reports that in 2022, Brazil produced around 23.66 million metric tonnes (mmt) of milk, while Mexico produced 12.98 mmt, and Argentina produced 11.9 mmt.

Domestic demand drives fluid milk production

Increased consolidated dairy operations, relatively easing prices of inputs such as feed, and increased domestic demand are forecast to drive up fluid milk production by 2% compared to 2023. Appreciation of Mexico’s peso since late 2022 is estimated to slightly lower producer input costs and result in higher production outcomes.

In addition, the favourable weather conditions in major milk-producing states and advanced dairy herd management in large-scale dairy operations will bolster continued milk production growth. Meanwhile, the integration of small-scale producers into bigger cooperatives or larger companies such as LaLa and Alpura leads to more efficiency and economies of scale.

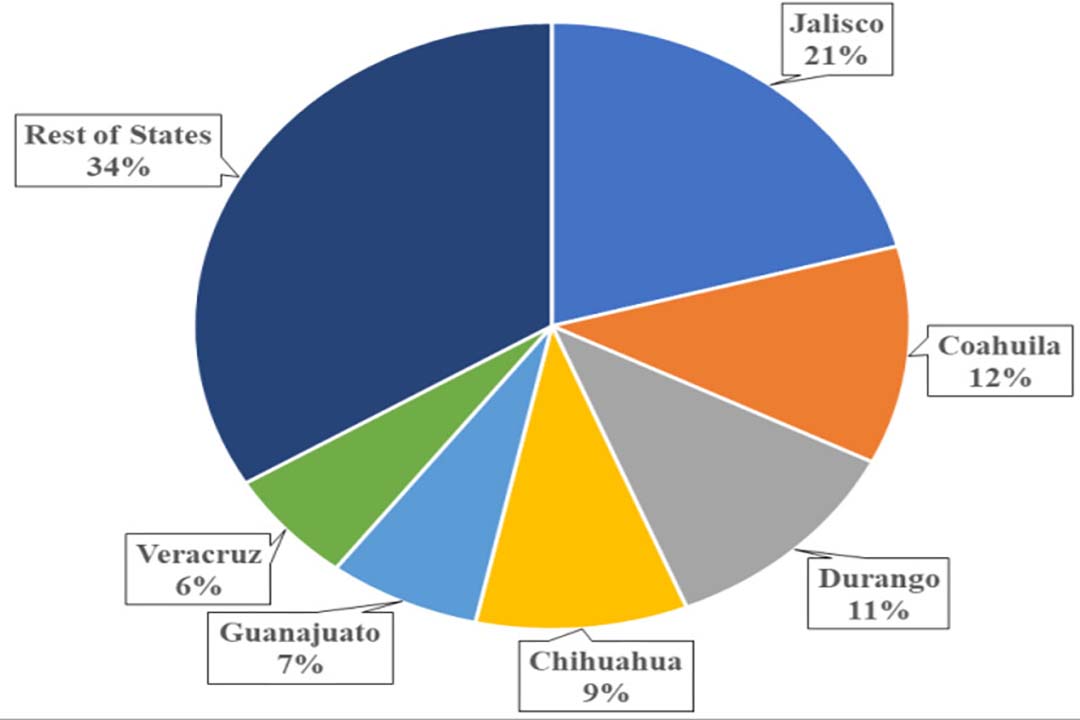

Figure 1 – Mexico’s leading milk production states, January-September 2023

*Source: Mexico’s agricultural statistics agency, Servicio de Información Agroalimentaria y Pesquera (SIAP)

The consumption forecast for 2024 is 13.8 mmt, a 2% increase compared to 2023. Fluid milk consumption patterns in Mexico are impacted by diverse factors, including price, health trends, and social media, all of which are expected to support an increase in consumption in 2024.

Fluid milk imports are forecast to grow in 2024 to meet demand from the retail sector in northern Mexico, after falling imports in 2023. Mexico’s favourable exchange rate in the first half of 2023 incentivised more dairy ingredient imports compared to fluid milk. Conversely, exports are forecast to remain flat to meet domestic demand for fresh milk for dairy processing.

Export demand to drive up cheese production

Domestic cheese production continues to grow due to increased domestic and export market demand. The production forecast for 2024 is 474,000 mt, a 2% increase compared to 2023. Domestic demand is led by the hotel, restaurant, and institution (HRI) sectors. Domestic cheese consumption forecast for 2024 is 645,000 mt, a 2% increase compared to 2023; cheese consumption in Mexico experienced steady overall growth over the last decade and is expected to continue to grow as economic inflation eases and household purchasing power increases.

In 2024, increased demand for cheese and forecast higher GDP is expected to drive up imports. Cheese imports will see a 5% increase compared to 2023. Similarly, exports will increase by 17% in 2024. The US is Mexico’s top market for cheese exports. However, large domestic companies such as Sigma Foods continue to seek export markets in regions such as Canada and South America.

Butter production to increase by 2%

The production forecast for 2024 is 250,000 mt, a 2% increase compared to 2023. Production is forecast to increase due to population growth and increased domestic demand from the HRI sectors. Mexico is ranked the fifth-largest butter consumer globally.

In 2024, relatively eased inflation and increased demand from the HRI sector are forecast to drive up imports by 17%. Opposed to imports, 2024 exports are forecast to remain flat; Mexico’s exports are strongly price-driven, and a strong peso exchange rate will limit exports.

Skimmed and whole milk powder

For skimmed milk powder (SMP), the production forecast for 2024 is 49,000 mt, a 2% increase compared to 2023; the increase is attributed to increased fluid milk production and expected increased use of the installed milk drying facilities, although full potential is hampered by a general limitation of milk drying infrastructure. An expected 11% increase in SMP consumption in 2024 will also support the increase in production. Unlike SMP, production of whole milk powder (WMP) remains flat in 2024, due to a lack of new installed capacity for domestic drying.

The SMP import forecast for 2024 is 450,000 mt, a 13% increase compared to 2023, driven by strong domestic demand and competitive international prices. On the other hand, strong domestic demand is forecast to be met by imports, and coupled with minimal local production, there will be little room for SMP export growth. Like SMP, imports of WMP will see a 33% increase in 2024. A lack of significant WMP domestic production increases and domestic demand is expected to keep exports flat.

Policy changes could shape the future of dairy

In 2023, the Mexican government published a series of anti-inflation decrees allowing the duty-free importation of certain food products including milk, cream, and milk powder. If the decrees are further extended or reintroduced, this would facilitate increases in imports of dairy products.

On the other hand, in June 2024, Mexico will elect a new president, and reports in the agricultural sector note that traditionally, more policy uncertainty exists during election years. In 2023, Mexico’s Secretary of Agriculture announced that 48 agricultural-related regulations would be updated by the end of the year.

The dairy sector remains attentive to any pre- or post-election changes to agricultural policy which could impact their operations. Reports show that dairy producers seek a long-term vision from the government for public policies and incentives for better technology, genetics, and workforce training.

Join 13,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the dairy sector, two times a week.