Dairygold looking for higher margin opportunities

Irish coop Dairygold’s strategic ambition is to build a business that delivers incremental growth and higher margin to the current core activities.

This ambition now has a clear focus on execution, following the establishment of the new Health & Nutrition business. Dairygold Health & Nutrition is already working on the delivery of the strategy through internal proposition development in selected markets and by targeting relevant acquisitions in the nutrition category.

That is how Jim Woulfe, CEO of Dairygold, explains the new direction for the largest farmer-owned dairy cooperation in the Republic of Ireland, based in the city of Mitchelstown in the southern County Cork. Woulfe, who has worked for the company for over 40 years, 12 of which as its CEO, also announced he will retire by the end of this year.

Highest ever intake

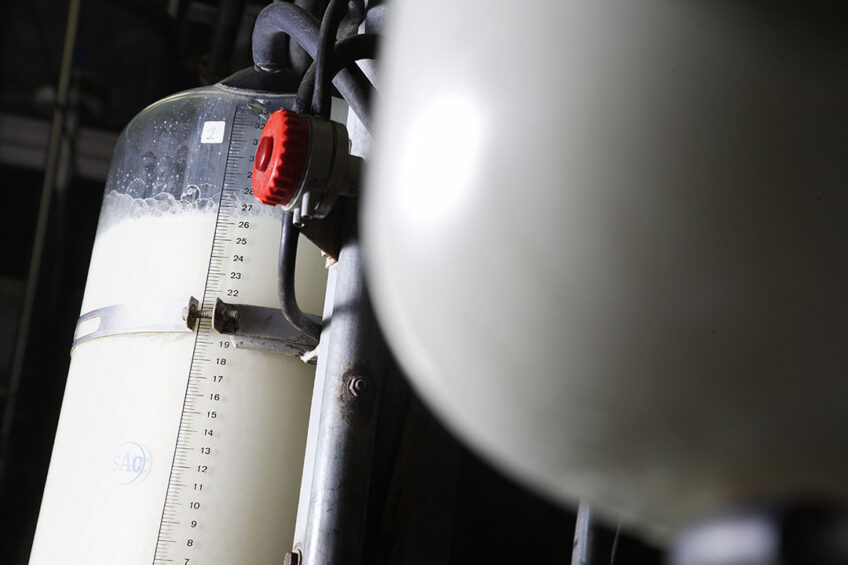

The Irish Coop nowadays has some 7,000 farmer-owners/milk suppliers. During 2020, Dairygold collected and processed 1.43 billion litres of milk, an increase of 2.7% on 2019 and the highest ever intake in its history. Despite the considerable market volatility because of Covid-19, Dairygold managed to pay a milk price of 34.7 eurocents a litre based on attainable quality and sustainability bonuses and the average milk solids received.

Dairy product markets

Dairy Global offers readers access to the futures market, a clear overview of prices for raw milk, dry whey, skimmed milk powder, cheese, and butter. Stay up to date…

Financially, turnover for the year was €1.017 billion, just shy of the €1.020 billion in 2019. EBITDA was €53.8 million, a fall of €2.8 million (4.9%) on the prior year, where 2019 significantly benefited from non-core property activities. Dairygold succeeded in substantially reducing its bank debt to a manageable €119.2 million. Member Funding increased to €27.9 million from €24.3 million during the year.

These are very satisfactory results given the market, economic and social conditions in which they were achieved and reflect Dairygold’s strong focus on operational performance and improving its working capital position,” Woulfe says.

Strong growth after end of European milk quota

Dairygold has its roots in the early 1900’s when two dairy cooperatives, Ballycloygh and Mitchelstown, were formed in this rural part of Ireland. In 1990, both organisations decided to merge and Dairygold was born. Over the last few years, the company has shown strong growth, especially after the end of the European milk quota. “With the world population projected to double by 2050, and the abolition of the EU milk quota system in 2015, we saw an opportunity to put a strong milk production and processing capacity plan in place for the next half-century,” it writes on its website. These days, the company has 3 activities, food ingredients supplying premium cheeses and dairy nutritionals made from milk whey and caseine, agribusiness for its Irish farmer-members, and a retail network of 39 shops in the Irish region of Munster.

Based on a survey of its members, the Irish cooperative predicts a further increase of the milk production across its suppliers base of circa 2.1% per annum. Current processing capacity is sufficient to deal with the forecast volume increases till 2025. Such an increase is in line with the Irish governments’ policy to further expand the national dairy industry and the all-important export of dairy products. Latest data over the first two months of 2021 from the Central Statistics Office in Dublin show an increase in the national milk production of 5.3% Y-O-Y to 534.7 million litres. In calendar year 2020, total national milk production in Ireland amounted to 8.292 million litres, an increase of 3.8% on the previous year.

Dairy product markets

Dairy Global offers readers access to the futures market, a clear overview of prices for raw milk, dry whey, skimmed milk powder, cheese, and butter. Stay up to date…

Next phase

For Dairygold, higher milk production in combination with the recent developments in consumer behaviour and demands, offers interesting new opportunities, chairman John O’Gorman says in the latest annual report. “We embark on the next phase of our continuing sustainable journey to deliver enhanced value for our Members.” A main tool is the recently established Health and Nutrition business which, according to Woulfe, can offer high value business opportunities. Dairygold follows in the footsteps of the other larger players in the Irish dairy market, Kerry Group and Glanbia, which also focus strongly on dairy ingredients for products like sport drinks, infant nutrition and specialised adult and medical nutrition. Dairygold aims to raise some €100 million for acquisitions of businesses in this field to kick-start the new division and further enhance its current portfolio. “Organic growth is the aim but we could make acquisitions to help us. We are not in talks with anyone yet. There is probably €70 million – €75 million on the balance sheet we could release. With modest leverage, it would bring us into a range of, probably, up to €100 million that we could spend,” Woulfe said.

Join 13,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the dairy sector, two times a week.